Large rise new claims for unemployment for week ending 1/9/21.

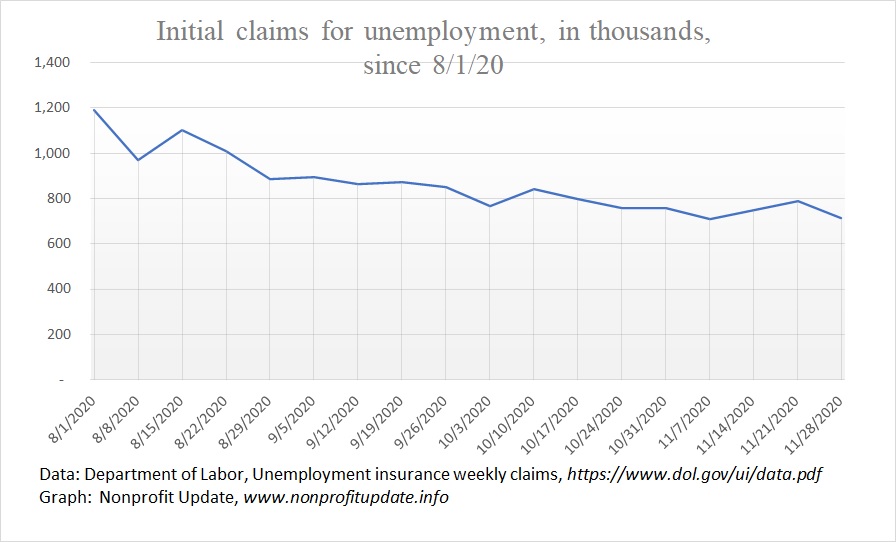

The number of new claims for unemployment for week ending 1/9/21 increased to 965,000, a deterioration of 181,000 from the prior week. That is the highest number of new state claims since 8/22/20.

Since 8/29/20, the new weekly claims have been in the 700Ks or 800Ks.

Keep in mind that before the shutdown of the economy the new claims averaged about 220K per week, so we are now running more than four times the previous norm.

The number of continuing claims for unemployment has been slowly dropping but increased for the week ending 1/2/21.

News report

Article at Wall Street Journal on 1/14/21 reports US Unemployment Claims Rise as Pandemic Weighs on Economy. Article link indicates the consensus is the increasing virus count combined with increasing restrictions on businesses caused the jump in new unemployment claims.

Article says there are other economic indicators suggesting the economy is slowing down again. Stats such as small business optimism, new home sales, existing home sales, household income, and household spending point towards a slowdown.

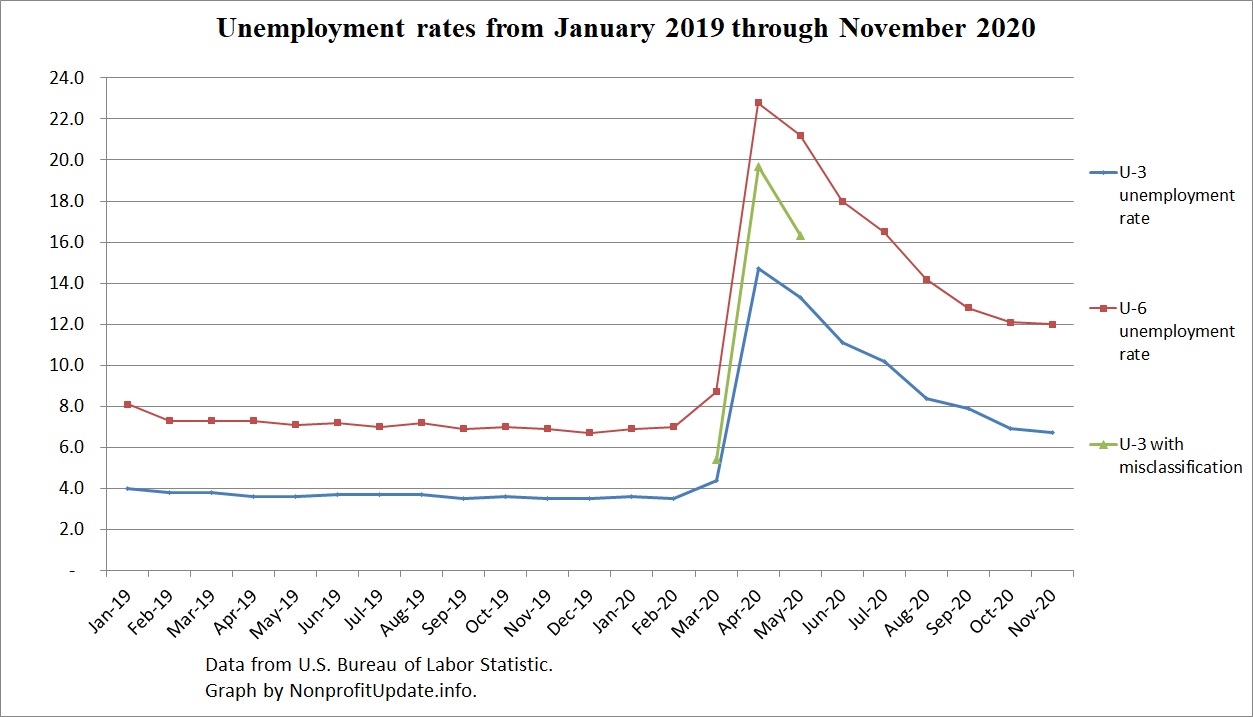

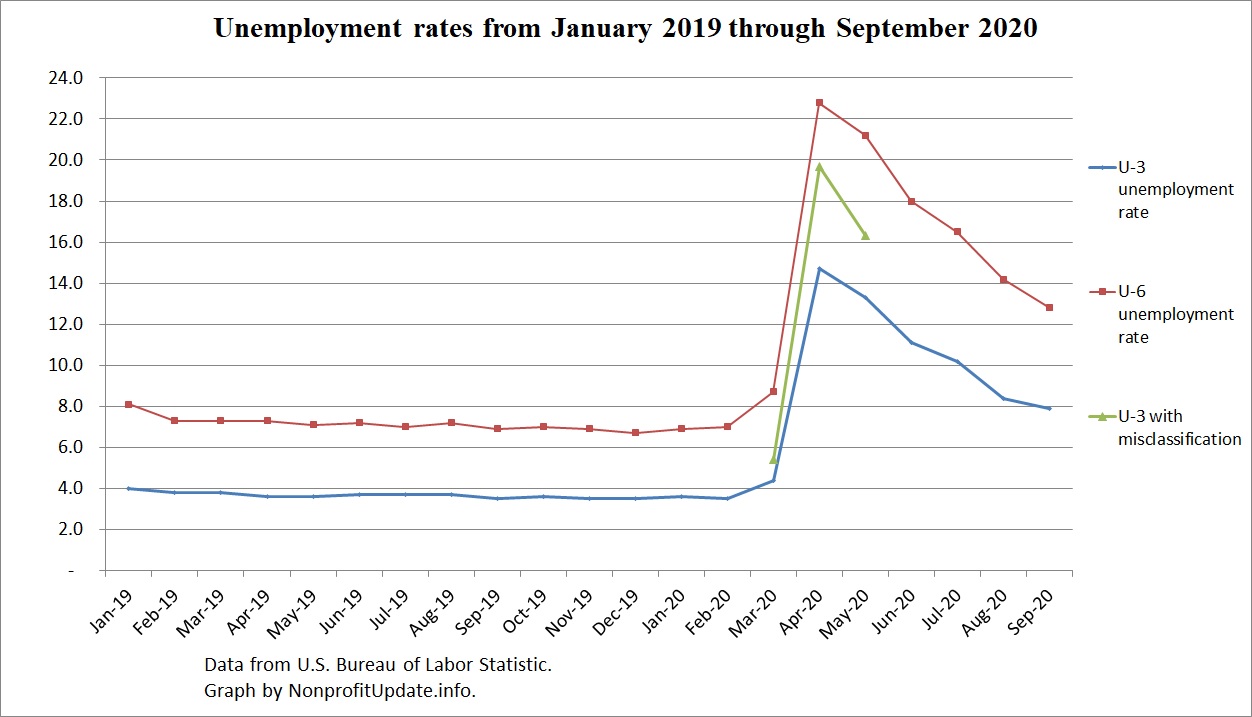

Following graphs show the devastation from the economic shutdown.

New claims

New claims for unemployment by week since the start of 2020:

…

Large rise new claims for unemployment for week ending 1/9/21.Read More »

Large rise new claims for unemployment for week ending 1/9/21. Read More »