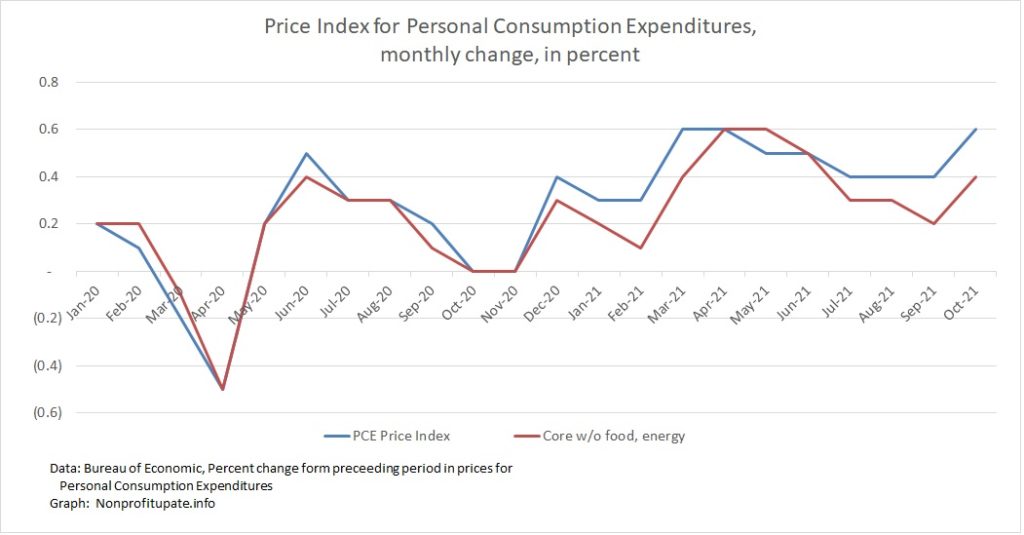

More explanation why the entire supply chain system is overloaded.

The supply chain for everything is tangle up to the extent it will take lots of time to function normally again.

Two articles describing the depth of issues:

- Analogy of turning off a complex computer system. Some of the hundreds of components won’t work when you throw the ‘on’ switch.

- Description of the demand side pressure on supply chain. All those trillions of federal dollars sloshing around have created demand which has overloaded distribution systems.

(Cross posted from my other blog, Nonprofit Update, because it will be helpful to understand broad supply chain issues for audits during the upcoming busy season.)

American Thinker – 12/11/21 – We broke everything in the name of Covid – Author ran a large IT department at one point in the past. Every few years they had to shut down the entire computer system so that the factory could go through maintenance of the electrical system.

…More explanation why the entire supply chain system is overloaded.Read More »